Eye Insurance Cost

The Real Eye Insurance Cost: Is It Worth the Premium?

Thinking about vision coverage? You are not alone! One of the first questions people ask when considering protecting their eyesight is, "What is the actual Eye Insurance Cost?" It's a great question, but the answer isn't always a simple dollar amount. Just like car insurance or health coverage, the total cost involves more than just the monthly premium.

We're going to break down everything you need to know about the cost of vision plans. We will explore the hidden fees, the factors that dictate your premium, and how to determine if enrolling in a vision plan truly makes financial sense for you and your family.

Decoding the Eye Insurance Cost Mystery

When we talk about the overall Eye Insurance Cost, we need to consider two main categories of expenses. First, there are the predictable, fixed costs, like your premium. Second, there are the variable, out-of-pocket expenses that pop up when you actually use the services.

Many individuals focus solely on the monthly premium and forget about the copayments, deductibles, and material allowances. Ignoring these secondary costs can lead to a nasty surprise when you try to purchase new glasses or contacts. Understanding the full picture is key to smart budgeting.

Factors That Influence Your Vision Insurance Premiums

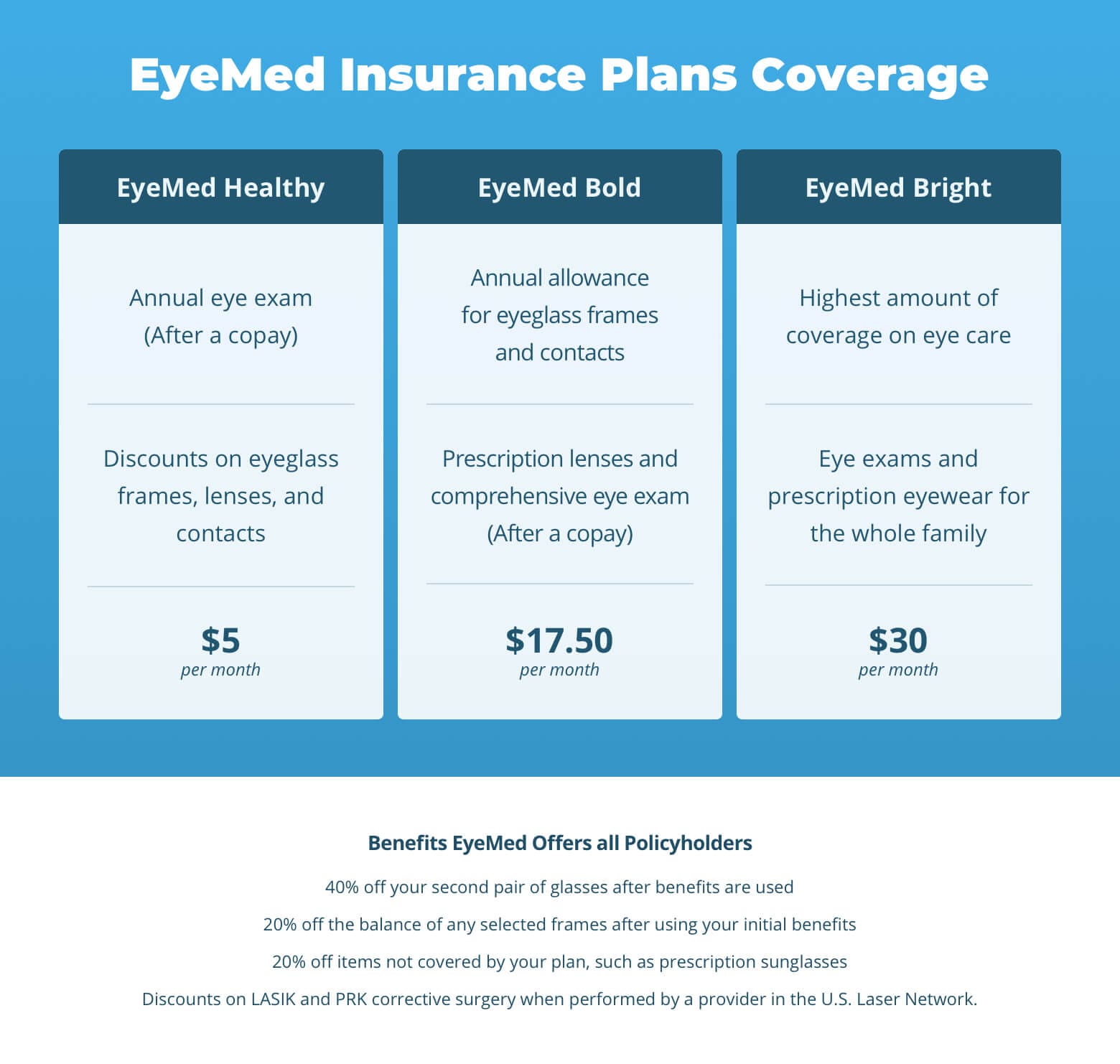

Why do some people pay $5 per month while others pay $25? Vision insurance costs are calculated based on several core factors. These variables help the insurance company assess the risk and the expected usage of the benefits.

The average premium for a basic individual vision plan usually falls between $7 and $20 per month. However, a premium comprehensive family plan could easily run over $50 monthly. Let's look closely at what drives these numbers.

Individual vs. Family Plans

This is probably the most straightforward factor. Insuring one person is significantly cheaper than insuring three or more. Family plans offer coverage for spouses and dependents, and while they cost more than individual plans, they often offer a substantial discount compared to buying multiple single policies.

If you have multiple family members who require yearly exams or corrective lenses, a family plan usually offers the best value. Always calculate the combined individual cost versus the quoted family rate to ensure you are getting the better deal.

Coverage Tiers and Network Types

Insurance companies offer different tiers of coverage, ranging from basic to premium. A basic plan might only cover standard lenses and annual exams, while a premium plan might include higher allowances for designer frames, specialty lenses (like progressives), and specific discounts on laser surgery.

Furthermore, the type of network matters greatly. PPO plans (Preferred Provider Organization) typically have higher premiums but offer more flexibility in choosing doctors. HMO plans (Health Maintenance Organization) usually have lower premiums but require you to stay within a strict network of providers.

Beyond Premiums: Understanding Out-of-Pocket Eye Insurance Cost

The premium is just the price of admission. Once you utilize your coverage, you encounter out-of-pocket costs. These are essential parts of the total Eye Insurance Cost and must be factored into your annual budget.

If you only pay $10 a month for your plan, but then have to shell out $150 in copays and another $100 because your frames exceed the allowance, your savings quickly shrink. Pay close attention to these details when selecting a plan.

Deductibles, Copayments, and Coinsurance

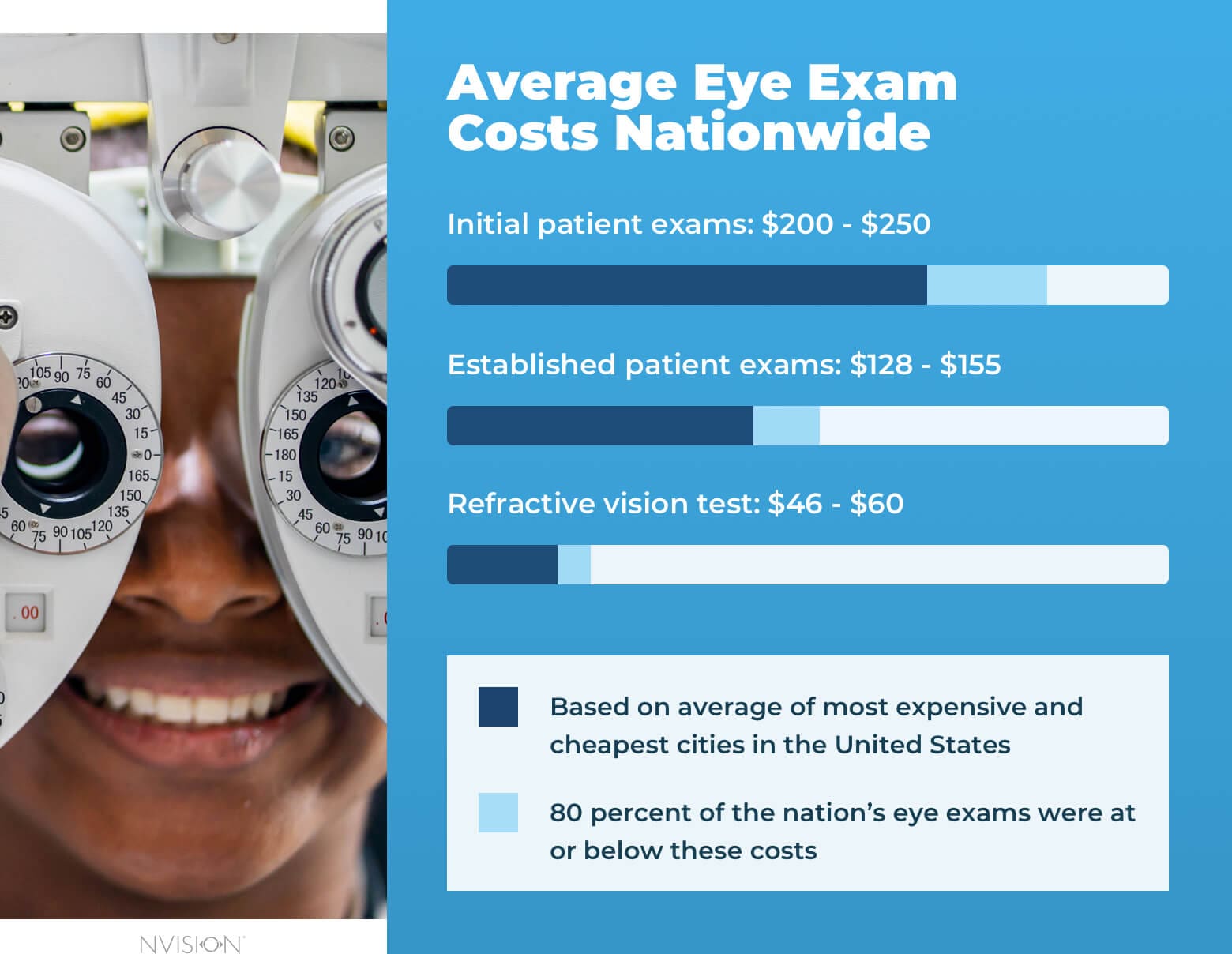

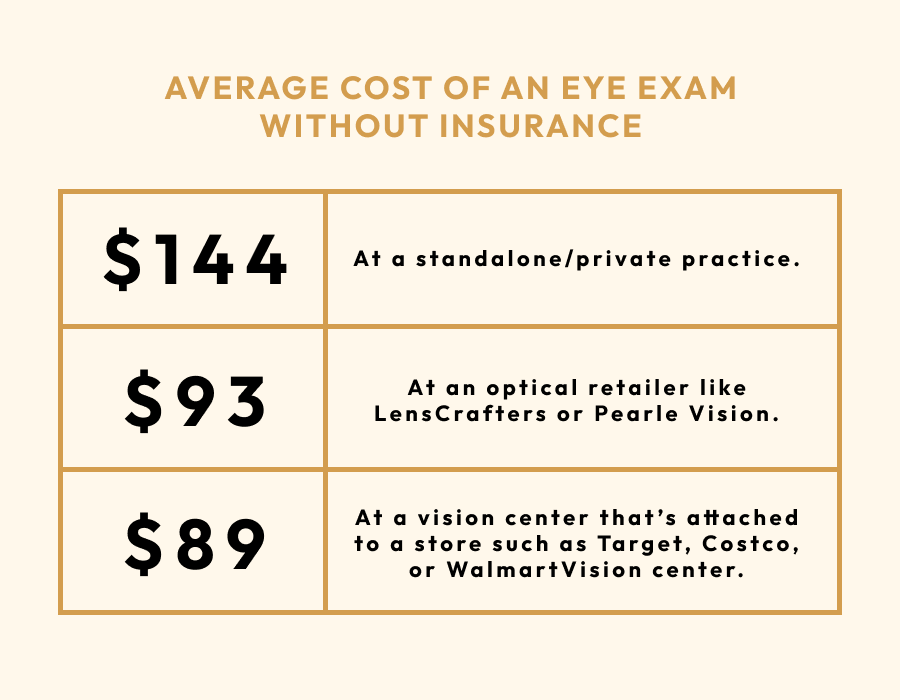

Unlike some major medical plans, many vision plans do not have a large annual deductible. However, copayments are extremely common. You might pay a fixed amount (e.g., $10-$25) for an annual eye exam and another amount (e.g., $20) for lenses.

Coinsurance is less common in pure vision plans but can apply to specialized or high-cost services, meaning you pay a percentage of the total cost after your initial coverage is applied. Always check your plan's Schedule of Benefits document for exact figures.

Annual Limits and Allowances (The Hidden Costs)

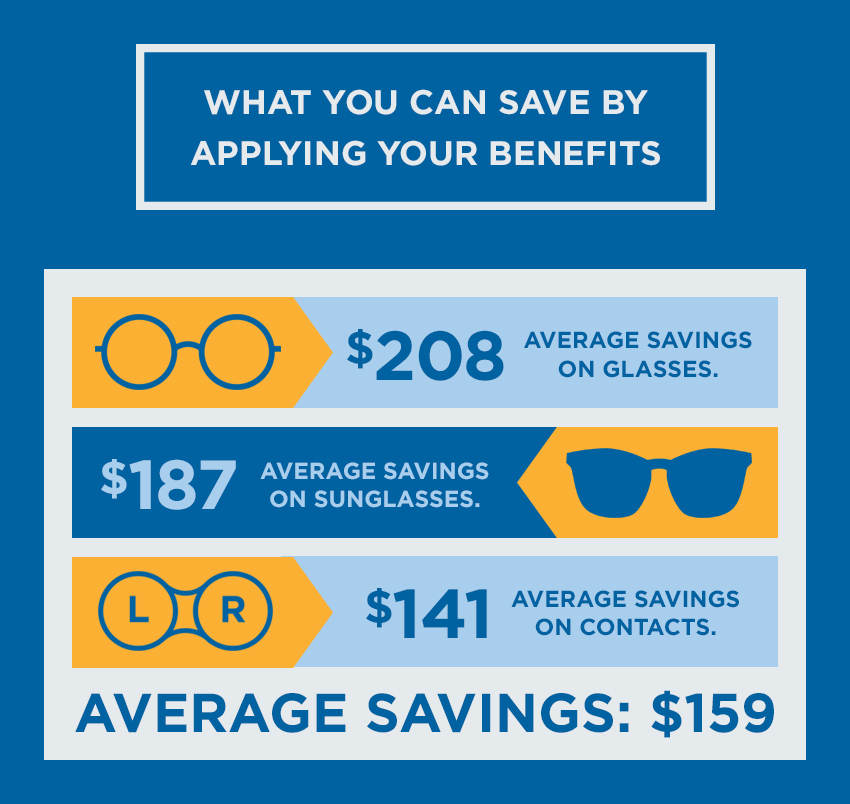

This is where vision plans differ most from traditional health insurance. Vision coverage typically operates on an allowance system. For example, your plan might grant a $130 allowance for frames every 12 or 24 months. If your chosen frames cost $250, you are responsible for the remaining $120.

Lenses also have limits, especially when it comes to coatings like anti-glare or scratch resistance. While the basic lens might be fully covered, the add-ons often incur an extra fee. If you always opt for premium features, your true out-of-pocket Eye Insurance Cost will be higher than someone who chooses basic materials.

Smart Strategies to Lower Your Eye Insurance Cost

No one wants to overpay, and luckily, there are several smart tactics you can employ to minimize your expenditure while still getting necessary care. Planning ahead is the biggest cost-saver when dealing with vision plans.

Here are some key ways to keep your total eye insurance spending down:

- **Maximize Plan Allowances:** Try to select frames and lenses that stay within your plan's allowance to avoid paying the difference.

- **Stick to Network Providers:** Using an out-of-network doctor will almost always result in higher charges and less coverage reimbursement.

- **Time Your Purchases:** If you are due for new glasses and your plan renews in January, wait until January 1st to use your new allowance rather than paying out of pocket in December.

Leveraging Employer-Sponsored Plans

If you have access to vision insurance through your employer, this is almost always the cheapest route. Employers usually subsidize a significant portion of the premium, making your monthly contribution incredibly low—sometimes just a few dollars.

Even if the employer plan is slightly more expensive on paper than a plan you find privately, the negotiated group rates and better overall benefits usually make it the superior choice. Do not skip checking your open enrollment packet!

Combining Dental and Vision Plans

Many insurance carriers offer bundling options for ancillary benefits like dental and vision. Purchasing these two plans together often results in a lower combined premium than buying them separately. This is a great way to save a few dollars every month, which adds up over the course of a year.

Always ask your insurer if they offer a dual-coverage discount. Sometimes, even if you already have dental coverage, switching to a combined provider can unlock these savings and streamline your insurance management.

Crunching the Numbers: When Does Eye Insurance Make Financial Sense?

The simplest way to calculate the value of vision insurance is to compare your total yearly Eye Insurance Cost (Premiums + Copays) against the retail price of your routine eye care needs. For the average person, vision insurance is a fantastic deal.

Consider this example: If your yearly premium is $150 and your copay is $20 for an exam, your total cost is $170. Without insurance, an exam might cost $100, and a basic pair of glasses could be $250. The insurance saves you money even before factoring in the discounts on lenses and frames.

If you don't need corrective lenses, but just a routine exam, the math is tighter. However, vision insurance also offers peace of mind and often screens for serious health conditions like glaucoma and diabetes, providing preventative benefits that are invaluable.

Conclusion

Understanding the full Eye Insurance Cost means looking past the monthly premium and budgeting for your potential out-of-pocket expenses. The true value lies in the significant discounts and allowances you receive on materials like frames and lenses, which are notoriously expensive at retail price.

For individuals who require annual eye exams and regular updates to their corrective lenses, vision insurance is usually a smart financial decision, especially when secured through an employer or as part of a bundle. Always read the fine print regarding allowances and frequency limits before committing to a plan.

Frequently Asked Questions About Eye Insurance Cost

- What is the average monthly Eye Insurance Cost?

- The average individual premium ranges from $7 to $20 per month for basic coverage. Comprehensive family plans can cost between $30 and $60 monthly, depending on the benefits offered.

- Is vision insurance worth it if I only wear contact lenses?

- Yes, absolutely. Many plans provide specific contact lens allowances, covering a portion of the yearly supply. Plus, you still need an annual eye exam, which the insurance significantly reduces the cost of.

- Does the premium cover prescription sunglass costs?

- Most vision plans allow you to use your frame and lens allowance toward prescription sunglasses. However, you often cannot use two separate frame allowances in the same year—you typically must choose between prescription glasses or prescription sunglasses.

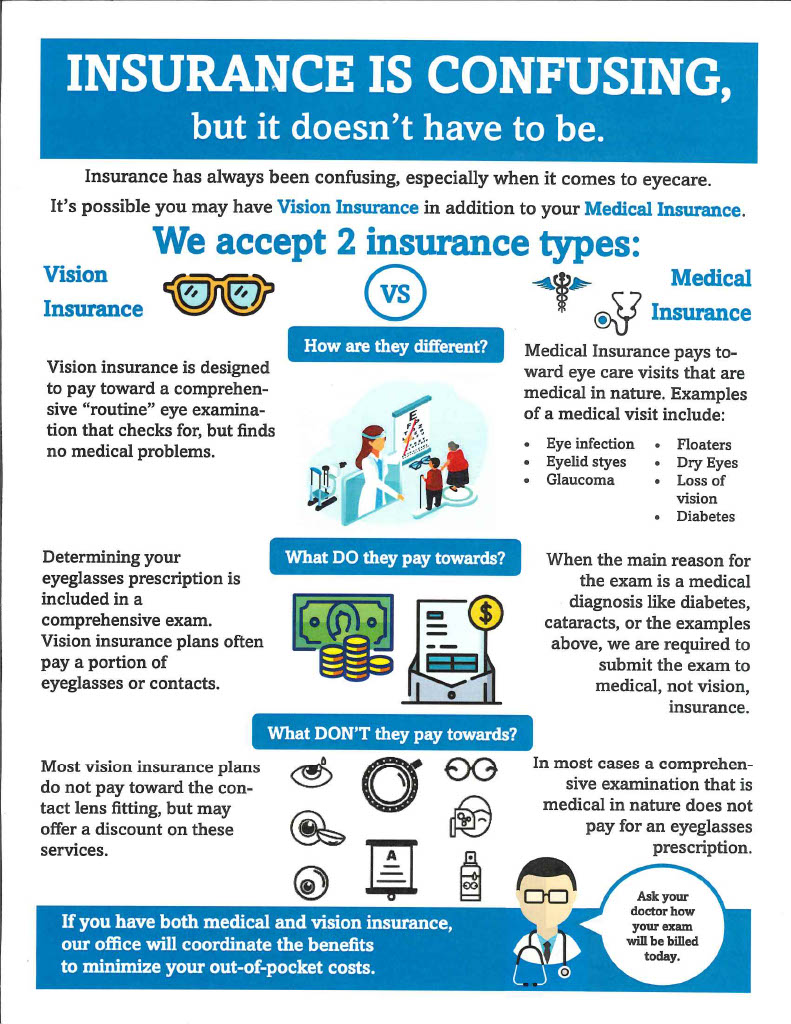

- Are eye disease screenings covered by standard vision insurance?

- Routine eye exams covered by vision insurance often include basic screenings for common diseases. However, treatment for serious eye diseases (like advanced cataracts or severe glaucoma) is usually covered under your primary health insurance, not the vision plan.

- What are the typical out-of-pocket costs I should expect?

- Expect a copayment ($10-$25) for your exam and potentially a copayment for your lenses. The biggest variable cost is exceeding the frame or lens allowance (typically $130-$200), which you pay out of pocket.

Eye Insurance Cost

Eye Insurance Cost Wallpapers

Collection of eye insurance cost wallpapers for your desktop and mobile devices.

Vivid Eye Insurance Cost Artwork Nature

Explore this high-quality eye insurance cost image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Eye Insurance Cost Photo Nature

Immerse yourself in the stunning details of this beautiful eye insurance cost wallpaper, designed for a captivating visual experience.

Mesmerizing Eye Insurance Cost Artwork Nature

Discover an amazing eye insurance cost background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush Eye Insurance Cost Background Concept

Find inspiration with this unique eye insurance cost illustration, crafted to provide a fresh look for your background.

Detailed Eye Insurance Cost Background Digital Art

Transform your screen with this vivid eye insurance cost artwork, a true masterpiece of digital design.

Exquisite Eye Insurance Cost Wallpaper for Mobile

Immerse yourself in the stunning details of this beautiful eye insurance cost wallpaper, designed for a captivating visual experience.

Stunning Eye Insurance Cost Moment for Desktop

Immerse yourself in the stunning details of this beautiful eye insurance cost wallpaper, designed for a captivating visual experience.

Captivating Eye Insurance Cost Photo Digital Art

A captivating eye insurance cost scene that brings tranquility and beauty to any device.

Stunning Eye Insurance Cost Image Illustration

This gorgeous eye insurance cost photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Eye Insurance Cost Landscape Digital Art

Find inspiration with this unique eye insurance cost illustration, crafted to provide a fresh look for your background.

Crisp Eye Insurance Cost Image Photography

Find inspiration with this unique eye insurance cost illustration, crafted to provide a fresh look for your background.

.jpg)

Vibrant Eye Insurance Cost Artwork for Mobile

Discover an amazing eye insurance cost background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Eye Insurance Cost Landscape Photography

This gorgeous eye insurance cost photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Eye Insurance Cost Moment Collection

Explore this high-quality eye insurance cost image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Eye Insurance Cost Scene in 4K

Transform your screen with this vivid eye insurance cost artwork, a true masterpiece of digital design.

Amazing Eye Insurance Cost Photo Photography

Discover an amazing eye insurance cost background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Eye Insurance Cost Capture Illustration

Immerse yourself in the stunning details of this beautiful eye insurance cost wallpaper, designed for a captivating visual experience.

High-Quality Eye Insurance Cost Landscape Photography

Transform your screen with this vivid eye insurance cost artwork, a true masterpiece of digital design.

Spectacular Eye Insurance Cost Landscape Nature

Find inspiration with this unique eye insurance cost illustration, crafted to provide a fresh look for your background.

Spectacular Eye Insurance Cost Scene Art

This gorgeous eye insurance cost photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these eye insurance cost wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Eye Insurance Cost"

Post a Comment