Eye Coverage Insurance

The Ultimate Guide to Understanding Eye Coverage Insurance

Let's be honest: dealing with insurance can often feel like navigating a maze blindfolded. But when it comes to safeguarding your sight, having the right information is critical. Your vision is one of your most valuable assets, and protecting it shouldn't be complicated or expensive. That's where quality Eye Coverage Insurance steps in.

If you're wondering what vision plans cover, how they differ from standard health insurance, and which plan is best for your family, you've come to the right place. We're going to break down everything you need to know about securing reliable coverage for your eyes, keeping things simple and straightforward.

This comprehensive guide will help you see clearly when it comes to choosing and utilizing your Eye Coverage Insurance benefits.

Why You Absolutely Need Eye Coverage Insurance

Many people mistakenly believe that their regular medical health insurance will cover all eye-related needs. Unfortunately, that's rarely the case. Standard health plans focus on major illnesses and injuries, not routine preventative care like annual eye exams and fitting for new glasses.

Without dedicated vision coverage, the costs associated with maintaining good sight can quickly add up. Think about the expense of yearly checkups, prescription lenses, frames, or contact lenses. These are routine necessities that can cost hundreds of dollars out-of-pocket every year.

Furthermore, regular eye exams aren't just about updating your prescription; they are crucial preventative health screenings. Many serious conditions, such as diabetes, high blood pressure, and even some tumors, can be detected early by an eye doctor during a routine visit. Having robust Eye Coverage Insurance makes these preventative screenings affordable and accessible.

Medical vs. Vision Insurance: What's the Difference?

This is perhaps the most important distinction to understand when budgeting for your health care. Standard medical insurance and vision insurance serve very different purposes.

Your standard medical insurance is designed to cover medically necessary procedures and treatments. If you suffer an eye injury, develop glaucoma, or need cataract surgery, your standard health plan will kick in (after deductibles and co-pays).

Vision insurance, or Eye Coverage Insurance, specifically handles routine, non-medical needs. This is the plan you use for:

- Annual eye examinations for prescription updates.

- Refraction fees (measuring for glasses).

- A specific allowance for frames and contact lenses.

- Discounts on elective procedures like LASIK surgery.

Essentially, if the visit is for wellness or prescription management, you need vision coverage. If it's for illness or injury, you need medical coverage.

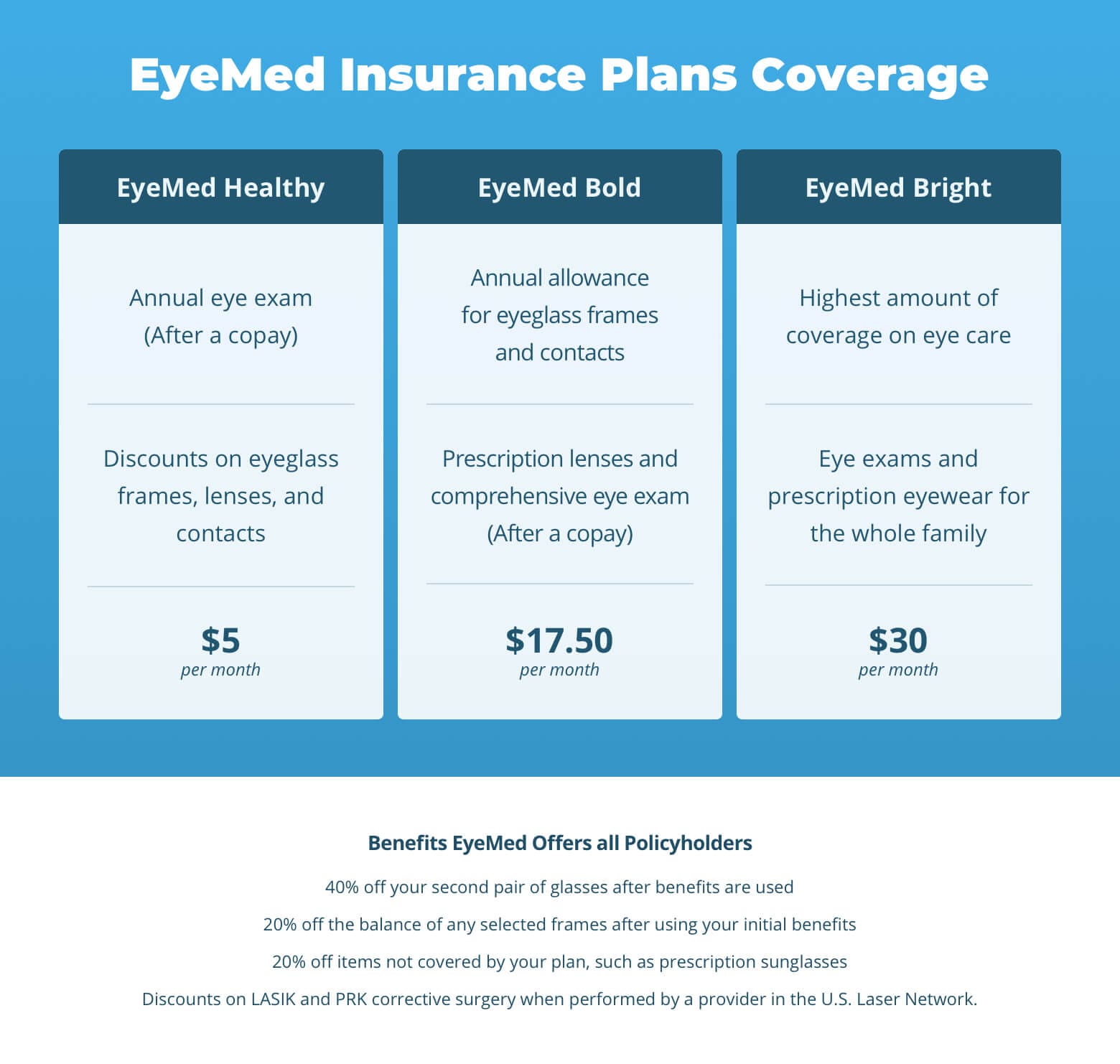

Types of Eye Coverage Plans Available

When shopping for Eye Coverage Insurance, you typically encounter two main categories of plans. Understanding the structure of these plans will help you select one that provides the best value based on your current healthcare setup and vision needs.

The choice often boils down to whether you prefer a bundled approach with your main health insurance or a flexible, separate policy.

Standalone Vision Plans

Standalone plans are policies purchased separately from your major medical insurance. These are generally very affordable and focus exclusively on vision care benefits. They often operate on a copayment system rather than requiring you to meet a high deductible first.

Many of these plans offer significant discounts even if you use an out-of-network provider, though your best benefits will always be through their preferred network of optometrists and ophthalmologists.

Key features of standalone plans:

- Low monthly premiums, making budgeting easier.

- Fixed copays for exams (e.g., $10 or $20 per visit).

- Specific monetary allowances for frames or contacts (e.g., $150 allowance every 12 months).

- Wider availability if your employer doesn't offer comprehensive vision coverage.

Integrated Health Plans

Integrated plans mean your vision benefits are bundled directly into your comprehensive medical insurance package. This is commonly seen in Affordable Care Act (ACA) marketplace plans, where pediatric vision coverage is mandatory for children up to age 19.

For adults, integrated coverage might be offered as an optional rider that you add to your existing medical premium. While this simplifies billing, the vision benefits may sometimes be less generous than those offered by a specialized standalone plan.

Always review the details carefully. Sometimes the vision benefit in an integrated plan only covers the exam, leaving the cost of lenses and frames largely on you.

What Does Eye Coverage Insurance Typically Cover?

Understanding the exact benefits of your vision plan is key to maximizing its value. Most Eye Coverage Insurance plans are structured around three core areas: routine exams, corrective lenses, and discounts.

It is important to note the frequency limitations of your plan. Most policies provide coverage for new frames once every 24 months, while exams and contacts are typically covered annually (every 12 months).

Routine Care Benefits

The foundation of any good vision policy is coverage for your annual checkup. This includes the optometrist's time for assessing your overall eye health and performing necessary tests.

Typically, routine care benefits cover the cost of the standard comprehensive eye exam. You may only be responsible for a small copayment, which is significantly cheaper than paying the full fee out-of-pocket.

These exams often include refraction, which is the test used to determine your prescription strength. Without coverage, the refraction fee alone can sometimes cost as much as the exam itself, so having Eye Coverage Insurance here is a huge benefit.

Coverage for Corrective Lenses

This is often the primary reason people purchase vision insurance. Whether you prefer glasses or contacts, your plan will help offset the high cost of corrective devices.

Most plans work on a set allowance system. For example, you might receive a $150 allowance towards frames and lenses every year or two years. If your chosen frames cost $200, you only pay the remaining $50.

If you prefer contact lenses, many plans offer an allowance for them instead of glasses. Keep in mind that you generally have to choose one benefit—contacts or frames—in a single benefit period, not both. Also, specialized coatings (like anti-glare or blue light filtering) are usually discounted but not fully covered.

Key Factors to Consider When Choosing Eye Coverage

Choosing the right plan means evaluating your lifestyle and existing vision needs. Here are the crucial elements you should investigate before signing up for any Eye Coverage Insurance policy.

First, check the network. Do you already have a trusted eye doctor? Make sure they are in-network with the proposed plan. Using an out-of-network provider usually results in higher costs and much smaller allowances for lenses and frames.

Second, compare the premium against the actual benefits. If you only wear reading glasses, a high-premium plan might not be worth it. However, if you or your children require annual prescription changes and expensive specialty lenses, a robust plan with a higher premium could save you money in the long run.

Third, look at the frequency limits. If your current glasses are holding up fine, a plan with a 24-month frame allowance might be acceptable. But if you are highly active or prone to losing frames, you may want a plan that allows for faster replacement or better discounts.

Finally, always scrutinize the limitations on lens upgrades. Progressive lenses, thin high-index lenses, and transition lenses often carry significant out-of-pocket costs, even with insurance. Know what percentage or dollar amount your plan contributes to these specific upgrades.

Conclusion

Investing in Eye Coverage Insurance is one of the smartest ways you can manage your healthcare budget and prioritize your long-term health. While it is separate from your major medical policy, it is an essential piece of the preventative health puzzle.

By understanding the differences between medical and vision plans, exploring standalone versus integrated options, and carefully reviewing the allowances for frames and lenses, you can select a plan that keeps your vision crisp and your finances stable. Don't wait until your next expensive eye appointment to get covered—start seeing the benefits of dedicated vision insurance today!

Frequently Asked Questions (FAQ) About Eye Coverage Insurance

- What is the difference between an optometrist and an ophthalmologist?

- An optometrist (OD) performs routine eye exams, vision testing, and corrective lens fitting. An ophthalmologist (MD) is a medical doctor specialized in eye and vision care who performs complex surgery and treats serious eye diseases. Both can be covered under your Eye Coverage Insurance, but ophthalmologists are often covered by standard medical insurance for surgical procedures.

- Is LASIK surgery covered by Eye Coverage Insurance?

- Generally, LASIK and other elective vision correction surgeries are not fully covered because they are considered cosmetic or elective. However, many Eye Coverage Insurance plans offer substantial negotiated discounts (often 10% to 50%) when you use a contracted surgeon.

- How often can I get new glasses or contacts?

- Most Eye Coverage Insurance plans allow for a new eye exam and a contact lens allowance annually (every 12 months). Frame allowances are typically offered every 12 or 24 months, depending on the specifics of your policy.

- If I have chronic dry eye, which insurance covers the treatment?

- Because chronic dry eye is a medical condition requiring treatment, diagnosis, and prescription medication (if applicable), it is usually covered by your standard medical insurance, not your routine vision insurance.

Eye Coverage Insurance

Eye Coverage Insurance Wallpapers

Collection of eye coverage insurance wallpapers for your desktop and mobile devices.

Vivid Eye Coverage Insurance Artwork Nature

Explore this high-quality eye coverage insurance image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Eye Coverage Insurance Photo Nature

Immerse yourself in the stunning details of this beautiful eye coverage insurance wallpaper, designed for a captivating visual experience.

Serene Eye Coverage Insurance Wallpaper in HD

Discover an amazing eye coverage insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Eye Coverage Insurance Background Digital Art

Transform your screen with this vivid eye coverage insurance artwork, a true masterpiece of digital design.

Spectacular Eye Coverage Insurance Artwork in 4K

Immerse yourself in the stunning details of this beautiful eye coverage insurance wallpaper, designed for a captivating visual experience.

Dynamic Eye Coverage Insurance Image for Mobile

Immerse yourself in the stunning details of this beautiful eye coverage insurance wallpaper, designed for a captivating visual experience.

Beautiful Eye Coverage Insurance Background Photography

Discover an amazing eye coverage insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Eye Coverage Insurance Background for Mobile

Immerse yourself in the stunning details of this beautiful eye coverage insurance wallpaper, designed for a captivating visual experience.

Stunning Eye Coverage Insurance Abstract Concept

Find inspiration with this unique eye coverage insurance illustration, crafted to provide a fresh look for your background.

Vivid Eye Coverage Insurance Image in 4K

Discover an amazing eye coverage insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality Eye Coverage Insurance Image Illustration

Discover an amazing eye coverage insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Eye Coverage Insurance Landscape Nature

Find inspiration with this unique eye coverage insurance illustration, crafted to provide a fresh look for your background.

Vibrant Eye Coverage Insurance Moment for Desktop

Experience the crisp clarity of this stunning eye coverage insurance image, available in high resolution for all your screens.

Amazing Eye Coverage Insurance Landscape Art

Explore this high-quality eye coverage insurance image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Eye Coverage Insurance Abstract Illustration

Find inspiration with this unique eye coverage insurance illustration, crafted to provide a fresh look for your background.

Beautiful Eye Coverage Insurance Landscape Art

Experience the crisp clarity of this stunning eye coverage insurance image, available in high resolution for all your screens.

Dynamic Eye Coverage Insurance Moment Concept

Find inspiration with this unique eye coverage insurance illustration, crafted to provide a fresh look for your background.

Detailed Eye Coverage Insurance Design Illustration

Experience the crisp clarity of this stunning eye coverage insurance image, available in high resolution for all your screens.

Serene Eye Coverage Insurance Wallpaper Nature

Transform your screen with this vivid eye coverage insurance artwork, a true masterpiece of digital design.

Beautiful Eye Coverage Insurance Picture Digital Art

Experience the crisp clarity of this stunning eye coverage insurance image, available in high resolution for all your screens.

Download these eye coverage insurance wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Eye Coverage Insurance"

Post a Comment