How To Get Eye Insurance

How To Get Eye Insurance: Your Comprehensive Guide

Let's face it, taking care of your eyesight is non-negotiable, but paying for eye exams, glasses, or contacts out-of-pocket can be incredibly expensive. This often leaves people scrambling and asking: How To Get Eye Insurance without breaking the bank? You've come to the right place.

Getting vision coverage doesn't have to be complicated. We're going to walk you through all the different options available, from workplace plans to individual policies, ensuring you have the clarity you need to protect your vision and your wallet.

Why You Need Eye Insurance

Many people assume that their standard medical insurance covers routine vision care. Unfortunately, that's rarely the case. Standard health insurance typically only kicks in for serious medical issues affecting the eye, like injuries or diseases (think cataracts or glaucoma). They won't pay for your annual check-up or new prescription lenses.

Vision insurance, often called a vision benefits plan, is designed specifically for preventive care and corrective eyewear. It turns unpredictable, high costs into manageable, fixed expenses.

Understanding the Types of Eye Coverage

Before you dive into finding a plan, it helps to know the two main categories of coverage. Understanding this distinction is key to figuring out the best answer to How To Get Eye Insurance for your unique situation.

There are two primary ways eye health expenses are covered:

- Vision Plans (Insurance): These plans cover routine vision expenses. This includes annual exams, a specific allowance for frames or contacts, and perhaps discounts on corrective procedures like LASIK.

- Medical Insurance: Your typical health plan covers medically necessary eye care, such as infections, injuries, or treatment for conditions like diabetic retinopathy. If your eye doctor discovers a serious medical problem during a routine exam, they will bill your medical insurance, not your vision plan.

Step-by-Step: How To Get Eye Insurance

Whether you're seeking coverage for yourself or your whole family, there are several straightforward avenues available. Here are the most common paths people take to secure vision coverage.

Option 1: Employer-Sponsored Plans

For most Americans, the easiest and most affordable route is through your workplace. Many employers offer vision coverage as part of their benefits package, often bundled with dental insurance.

Check with your Human Resources (HR) department during the open enrollment period. Employer plans usually benefit from group discounts, meaning your premiums will likely be lower than if you bought an individual plan.

Option 2: Buying Individual or Family Plans

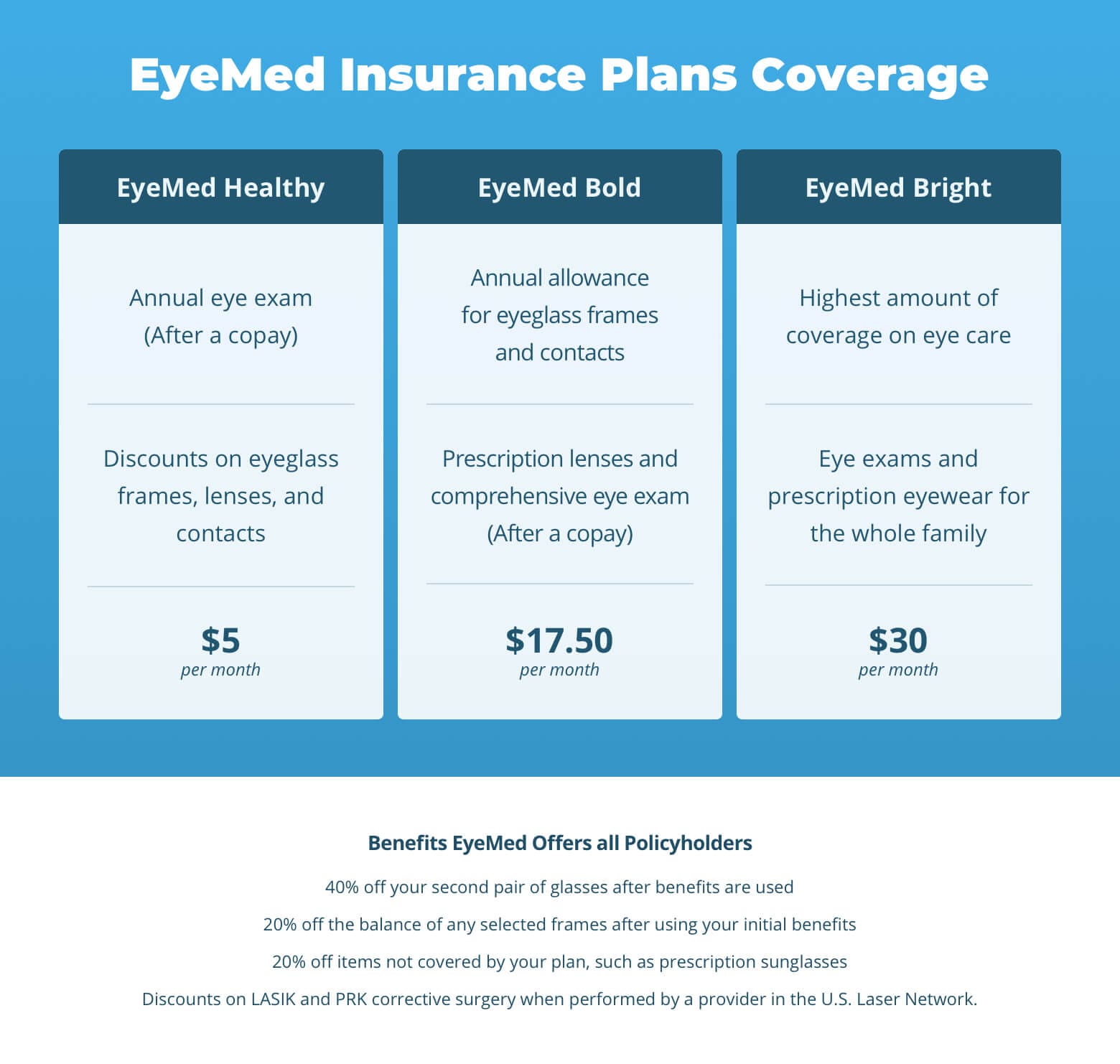

If your employer doesn't offer vision coverage, or if you are self-employed or retired, you can purchase a stand-alone vision plan directly from an insurance company. Major carriers like VSP, EyeMed, and others offer individual policies.

These plans are excellent because they offer maximum flexibility. You can tailor the deductible and benefit limits to match your specific vision needs, making this a highly customized solution for How To Get Eye Insurance.

What to look for when buying direct:

- Compare quotes from at least three different providers.

- Verify that your current eye doctor is in their network.

- Understand the waiting period for certain benefits (like frames or contacts).

Option 3: Health Insurance Marketplace (ACA)

The Affordable Care Act (ACA) Marketplace (HealthCare.gov) allows you to purchase comprehensive health coverage. While vision coverage for adults is optional under the ACA, vision coverage for children (pediatric vision) is considered an essential health benefit.

When shopping on the Marketplace, you might find that vision benefits are included in your overall medical plan, or you might need to purchase a separate stand-alone vision plan, especially if you need adult coverage.

Key Factors to Consider When Choosing a Plan

Once you know where to look, the next challenge is selecting the right plan. It's vital to compare apples to apples, as policies can differ dramatically in what they cover and how much they cost you annually. Pay attention to the fine print.

Network and Providers

Does the plan operate using a Health Maintenance Organization (HMO) model, requiring you to stay in-network, or does it offer a Preferred Provider Organization (PPO) model with more flexibility? If you love your current optometrist, always confirm they accept the new insurance before enrolling. Going out-of-network often results in significantly higher costs or no coverage at all.

Costs: Premiums, Deductibles, and Co-pays

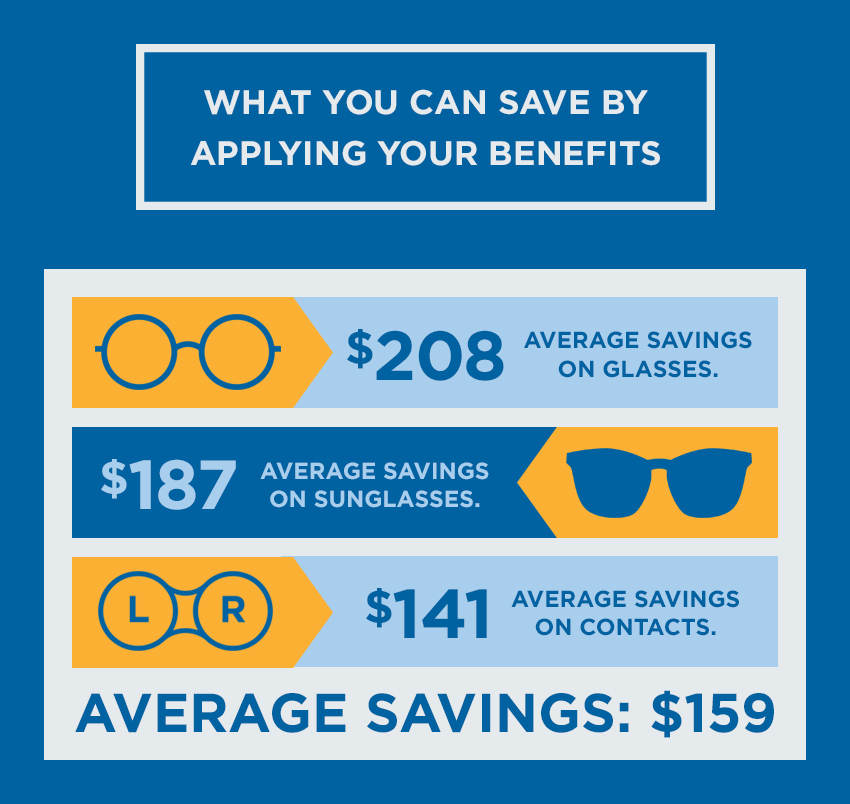

Calculate your total expected annual expense. A plan with a low monthly premium might have higher co-pays or a very small allowance for frames, meaning you end up paying more at the point of service. Conversely, a higher premium often provides better coverage and lower out-of-pocket costs later on.

Reviewing Vision Benefits

This is where you determine what the plan actually gives you for your money. Look specifically at the benefit schedule for frames and lenses.

Ask these critical questions about coverage:

- How often can I get an eye exam (usually once every 12 months)?

- What is the allowance for frames (e.g., $150 credit)?

- Does the plan cover standard lenses fully, and what are the upgrade costs for anti-glare, progressives, or high-index lenses?

- Is there a separate allowance for contacts, and if so, how many months supply?

- Are discounts offered for elective procedures like LASIK?

If you wear contacts, ensure the plan's contact allowance is generous enough to cover your annual supply, as some plans only offer minimal coverage if you opt for contacts instead of glasses.

Alternatives to Traditional Eye Insurance

Maybe traditional insurance isn't quite the right fit for your budget or lifestyle. That's okay! There are other innovative methods you can use to manage your vision care costs.

Vision Discount Programs

These are not insurance plans, but membership programs. You pay a small annual fee and, in return, receive substantial discounts on exams, frames, lenses, and sometimes specialized procedures. This is a fantastic option if you only need coverage for basic services and don't want the commitment of monthly premiums.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

If you have an HSA or FSA through your medical plan, you can use these tax-advantaged funds to pay for almost any vision-related expense, including co-pays, deductibles, glasses, contacts, and even LASIK. This is a smart financial strategy, even if you already have a vision plan.

Conclusion

Finding the answer to How To Get Eye Insurance boils down to assessing your needs, understanding your options, and carefully reviewing the costs versus the benefits. Whether you choose an employer plan, buy an individual policy, or opt for a discount program, securing vision coverage is a wise investment in your long-term health and financial stability.

Don't put off that annual eye exam. Start comparing quotes today and give yourself the gift of clear vision!

Frequently Asked Questions (FAQ) About Eye Insurance

- Does regular health insurance cover routine eye exams?

- Generally, no. Standard medical insurance covers medically necessary eye care (injuries, infections, diseases) but rarely covers routine exams, glasses, or contact lenses. You usually need a separate vision plan for those benefits.

- Is vision insurance worth the cost?

- For most people, yes. If you or your family members wear glasses or contacts, the cost of one annual exam and a new pair of frames usually far exceeds the total annual premium cost of a vision plan, resulting in significant savings.

- How often can I get new glasses under a vision plan?

- Most vision plans allow for new lenses and/or frames once every 12 or 24 months. Be sure to check your specific plan's frequency limits, as this is a common point of confusion.

- Can I use my vision insurance online?

- Many major vision carriers (like VSP and EyeMed) partner with large online retailers. You can often use your frame allowance and prescription benefits directly on these websites, though coverage may vary compared to in-office purchases.

- Are there waiting periods for vision insurance?

- If you purchase an individual plan (not through an employer), there may be a short waiting period (30-90 days) for major benefits like frames or lenses. Routine exams, however, are often covered immediately.

How To Get Eye Insurance

How To Get Eye Insurance Wallpapers

Collection of how to get eye insurance wallpapers for your desktop and mobile devices.

Detailed How To Get Eye Insurance Background Digital Art

Transform your screen with this vivid how to get eye insurance artwork, a true masterpiece of digital design.

Artistic How To Get Eye Insurance Photo Nature

Immerse yourself in the stunning details of this beautiful how to get eye insurance wallpaper, designed for a captivating visual experience.

Stunning How To Get Eye Insurance Image Illustration

This gorgeous how to get eye insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid How To Get Eye Insurance Artwork Nature

Explore this high-quality how to get eye insurance image, perfect for enhancing your desktop or mobile wallpaper.

Detailed How To Get Eye Insurance Design Illustration

Experience the crisp clarity of this stunning how to get eye insurance image, available in high resolution for all your screens.

Captivating How To Get Eye Insurance Landscape Digital Art

Find inspiration with this unique how to get eye insurance illustration, crafted to provide a fresh look for your background.

Spectacular How To Get Eye Insurance Scene Art

This gorgeous how to get eye insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Eye Insurance Moment for Desktop

Immerse yourself in the stunning details of this beautiful how to get eye insurance wallpaper, designed for a captivating visual experience.

High-Quality How To Get Eye Insurance Landscape Photography

Transform your screen with this vivid how to get eye insurance artwork, a true masterpiece of digital design.

Stunning How To Get Eye Insurance Scene Nature

This gorgeous how to get eye insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get Eye Insurance Artwork Nature

A captivating how to get eye insurance scene that brings tranquility and beauty to any device.

Breathtaking How To Get Eye Insurance Image Nature

Explore this high-quality how to get eye insurance image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get Eye Insurance Image Photography

Explore this high-quality how to get eye insurance image, perfect for enhancing your desktop or mobile wallpaper.

Serene How To Get Eye Insurance Artwork Digital Art

Experience the crisp clarity of this stunning how to get eye insurance image, available in high resolution for all your screens.

Crisp How To Get Eye Insurance Artwork Art

A captivating how to get eye insurance scene that brings tranquility and beauty to any device.

Exquisite How To Get Eye Insurance Landscape Nature

Find inspiration with this unique how to get eye insurance illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get Eye Insurance View Illustration

Transform your screen with this vivid how to get eye insurance artwork, a true masterpiece of digital design.

Dynamic How To Get Eye Insurance Abstract in HD

A captivating how to get eye insurance scene that brings tranquility and beauty to any device.

Crisp How To Get Eye Insurance Background for Mobile

Immerse yourself in the stunning details of this beautiful how to get eye insurance wallpaper, designed for a captivating visual experience.

Gorgeous How To Get Eye Insurance Scene Digital Art

A captivating how to get eye insurance scene that brings tranquility and beauty to any device.

Download these how to get eye insurance wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Eye Insurance"

Post a Comment